can i get a mortgage if i owe back taxes canada

Having tax debt also called back taxes does not preclude you from qualifying for a mortgage by sheer virtue of having it. So the short answer to the question can I get a mortgage if I owe taxes is unfortunately not likely.

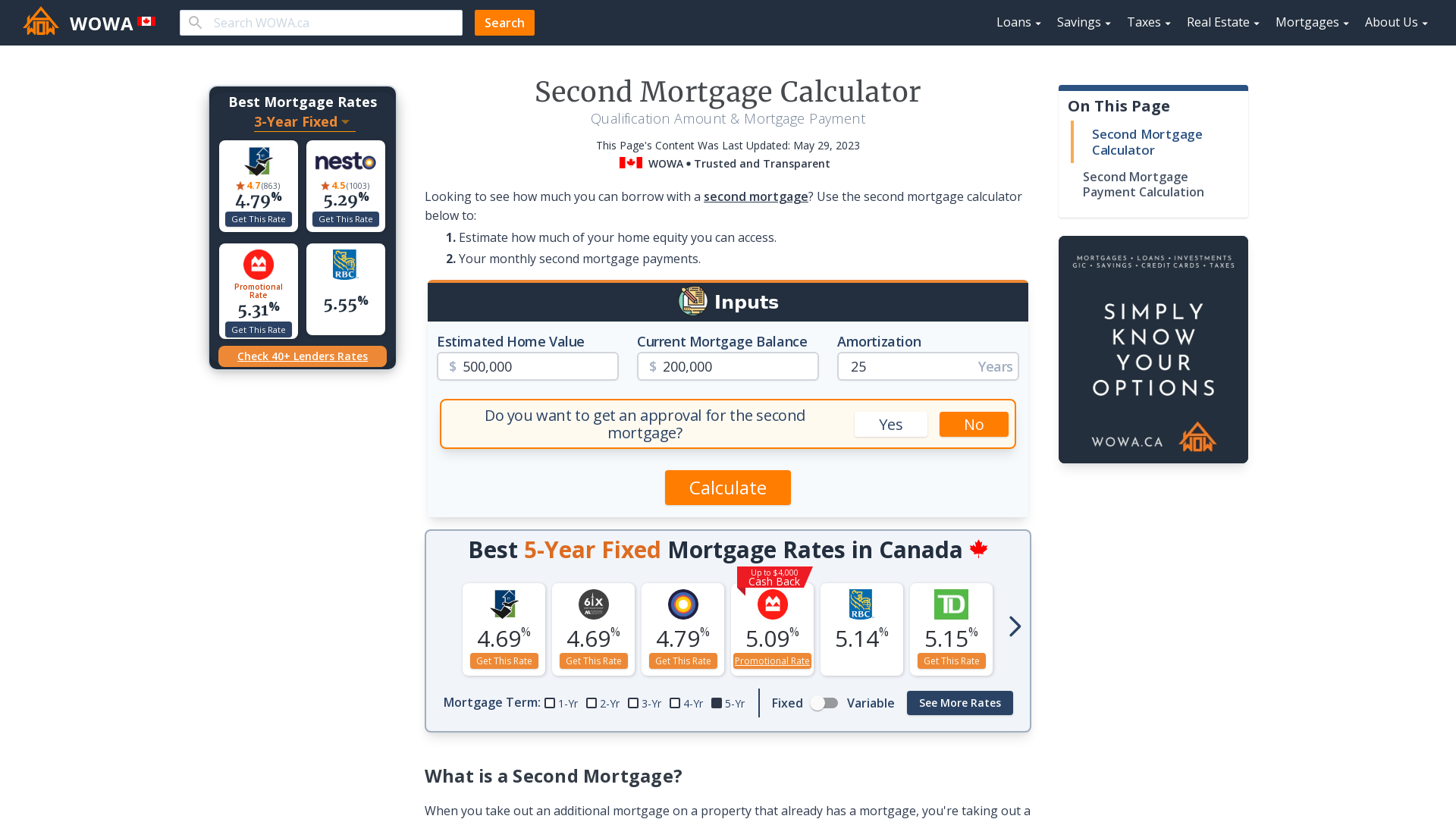

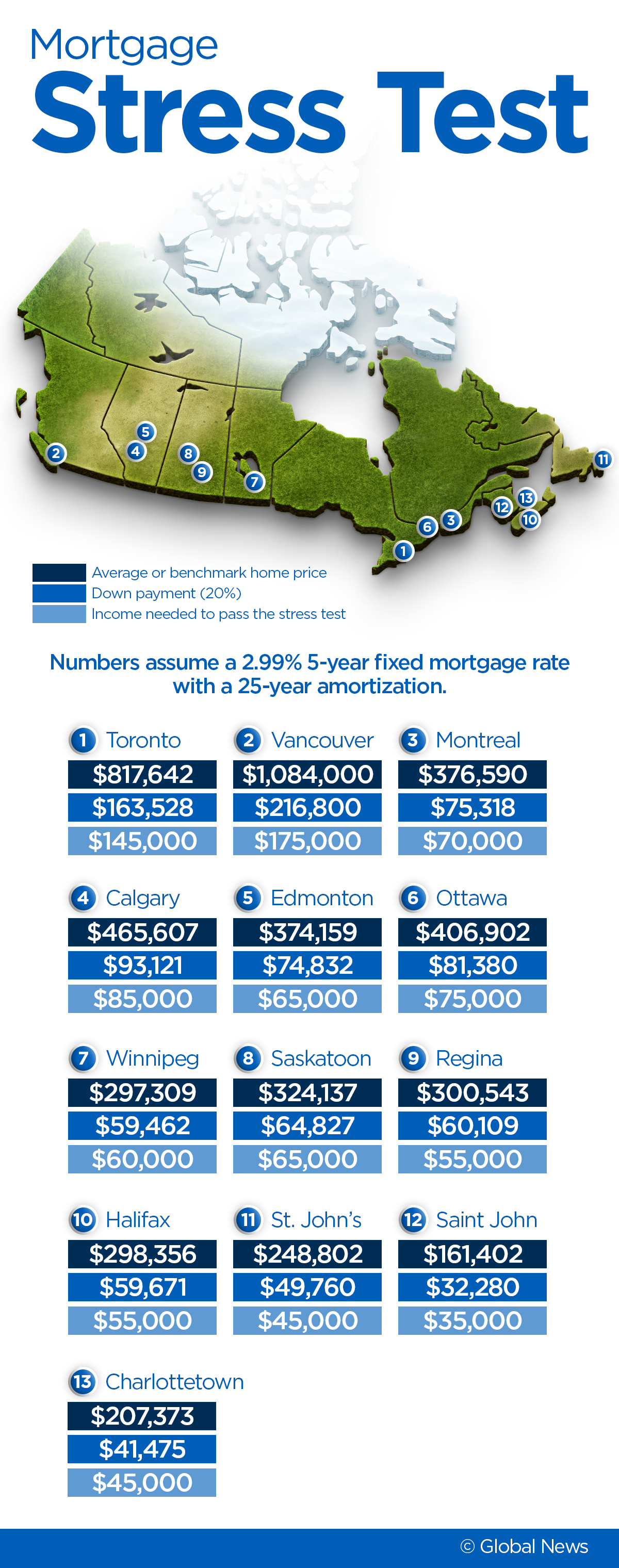

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

Alternatively you can contact Robert here.

. 1 If you owe the IRS back taxes you have to take the initiative and make a payment plan with the IRS right away. Back taxes no mortgage until now If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a mortgage. If you are convicted of tax evasion it can also lead to court-imposed fines jail time and a criminal record.

If you owe back property taxes the taxing authority gets a lien on your house for the amount due plus any interest and penalties. So if you dont file you receive notices with this estimated amount and the IRS can file a return on your behalf. Many people dont think its possible to get a mortgage if you owe the IRS back taxes.

Mortgage and back taxes. In short yes you can. Not paying your taxes is a crime and has major financial and personal costs.

Can I Get a Mortgage If I Have Not Filed My Tax Returns. Im happy to tell you that it is possible and this is how you do it. Back taxes no mortgage until now If you are paying back taxes with an installment plan most mortgage programs required you to clear your tax debt before getting a.

Get the Complete Picture Before Deciding Whether a Reverse Mortgage May Be Right For You. Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. Robert Floris is a Mortgage Broker.

New rules allow you to get a mortgage loan when you owe money to the IRS allowing you to purchase a wonderful house in a great area. Can You Get A Mortgage If You Owe Back Taxes To The Irs If You Owe Income Taxes Can You Get A Mortgage Yes Jvm Lending Can The Irs Seize My Property Yes H R Block Home Buying Tax Deductions What S Tax Deductible Buying A House Tax Deductions Estate Tax Real Estate Advice Can I Buy A House If I Owe Back Taxes. Tax debt caused by back taxes you owe are not easy to get away from.

Can you get a mortgage if you owe back taxes to the IRS. If keeping your DTI low is most important to you then you may want to consider keeping the monthly payment on your repayment plan as low as possible. Which means for you to.

The IRP can also be used to assess the amount of taxes you should owe. The short answer is that owing the IRS money wont automatically prevent you from qualifying for a home loan. Can you get a reverse mortgage if you owe back property taxes.

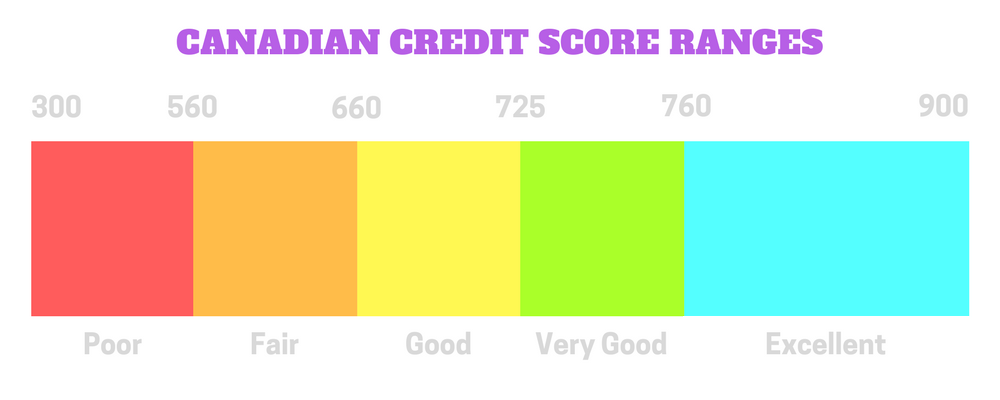

Get the Best Rates. The answer can depend on your particular situation. Mortgage lenders are focusing on if you owe CRA money and will require you to prove your taxes have been paid before lending.

Nothing has shown up on my CR and they havent started enforcing. Mortgagees are required to determine whether the Borrowers have delinquent federal non-tax debt. Mortgagees are prohibited from processing an application for an FHA-insured Mortgage for Borrowers with delinquent federal non-tax debt including deficiency Judgments and other debt associated with past FHA-insured Mortgages.

During my real estate career I have been amazed by several buyers who did not understand the need to have their financial house in order before they apply for a mortgage. A tax debt doesnt equal a blanket rejection for a mortgage application. I owe back taxes from like 7 years ago approx.

I am planning on applying for a mortgage in the September 2008 timeframe. Also important for a self-employed borrower is that you can use your NOAs average of last 2 years to prove what income you earn for mortgage qualifying see Line 150 - Total Income. If convicted of tax evasion you must repay the full amount of taxes owing plus interest and any civil penalties assessed by the Canada Revenue Agency CRA.

Borrowers who have had late payments on their current mortgages or their other property charges Taxes insurance HOA dues etc in the past 24 months can still get a reverse mortgage but HUD now requires them to get a Life Expectancy Set Aside LESA or Lee Sah to pay their taxes an insurance from their loan proceeds. Do you owe back taxes to the IRS or StateYouve found your dream home and just before you make it to closing you learn that the IRS has filed a tax. Generally if you make a payment plan right away with them they wont file a lien against you.

If you would like to speak with Robert he can be reached at 905-574-9200 215. If you owe a little bit in taxes because of some mishaps but intend to pay them promptly late penalties and all youll have less of a problem acquiring a mortgage than someone who has been purposely evading their taxes for a long time. Ad Get a Free Quote Now with No Obligation.

They just send me out a letter annually telling me I owe them. So if the principal and interest on your mortgage totals 2000 per month and your annual property tax bill is 2400 thats an additional 200 a month tacked onto your payment. So the short answer to the question can I get a mortgage if I owe taxes is unfortunately not likely.

HOA dues the lender will require a Life Expectancy Set Aside per HUD guidelines to pay these expenses from your loan. Some lenders want you to add your property taxes into the monthly mortgage payment you make to be sure those payments get paid on time. However if you owe a lot in taxes even if youre in the midst of paying them back it could be difficult to get approved for a.

Why its better to address back taxes sooner rather than later. All taxes must be brought current at the time of the loan and if you have been late on property taxes mortgage payments or any other property charges in the past 24 months ie. His office is located at 651 Fennell Avenue East in Hamilton Ontario.

Check Your Eligibility for Free. This includes having filed your taxes for the preceding two to three years. This will keep your monthly totals down which could keep you below.

Our 4 step plan will help you get a home loan to buy or refinance a property.

Downsides Of A Reverse Mortgage Understanding Pros And Cons

Reverse Mortgage Problems Myths And Truths Homeequity Bank

Mortgage Documents Checklist Loans Canada

How To Make Your Canadian Mortgage Interest Tax Deductible

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

Pin By Jessica Hufford On Money Tax Checklist Tax Prep Checklist Tax Preparation

Marketing Home Coding Marketing Good Things

Should You Pay Property Taxes Through Your Mortgage Loans Canada

So You Owe The Irs Bummer Here S How To Plan Better For Next Year Irs Taxes Property Tax Tax

Infographic It S Your Money A Practical Guide The Super Savers Infographic Savers Finance Saving

Self Employed Mortgage Options Qualifications Wowa Ca

Mortgage Document Checklist What You Need Before Applying For A Mortgage

What Happens If You Miss A Mortgage Payment Loans Canada

Smith Manoeuvre Canada How To Make Your Mortgage Tax Deductible Mortgage Canada Youtube

Free Budget Worksheets Household Net Worth Spreadsheet Budgeting Worksheets Personal Budget Budgeting

Holidays In Selected Countries Notice The Uk Is Relatively Low On This List Although Some Typically Produ Holiday Pay Teaching Inspiration Best Pictures Ever